Recent statistics reveal that Microstrategy, a company known for its business intelligence, mobile software, and cloud services, has seen a significant increase of over 30% in its bitcoin investments. The company invested a total of $5.314 billion, with the current value of its bitcoin cache reaching $6.915 billion, marking a substantial profit of $1.601 billion.

Microstrategy’s Profits Have Risen by More Than 30% or 40,401 Bitcoin

Microstrategy (Nasdaq: MSTR) has experienced this notable growth following bitcoin’s (BTC) surge past the $39K mark. Currently, Microstrategy stands as the largest holder of bitcoin, surpassing both public and private entities, with the exception of governments and exchange-traded products such as Grayscale’s GBTC. As of the latest update, the company holds an impressive 174,530 BTC, currently valued at $6.915 billion based on the prevailing exchange rates.

Microstrategy’s investment in BTC, amounting to $5.314 billion, was acquired at an average cost of $30,252 per BTC. With its current valuation at $6.915 billion, the company has realized a gain of $1.601 billion, equating to a 30.12% return through strategic dollar-cost averaging of its purchases. According to archived data from blockchaincenter.net’s “There Is No Second Best,” this analysis tracks Microstrategy’s profit margin with BTC investments, comparing it with potential earnings had the company invested in ethereum (ETH) instead.

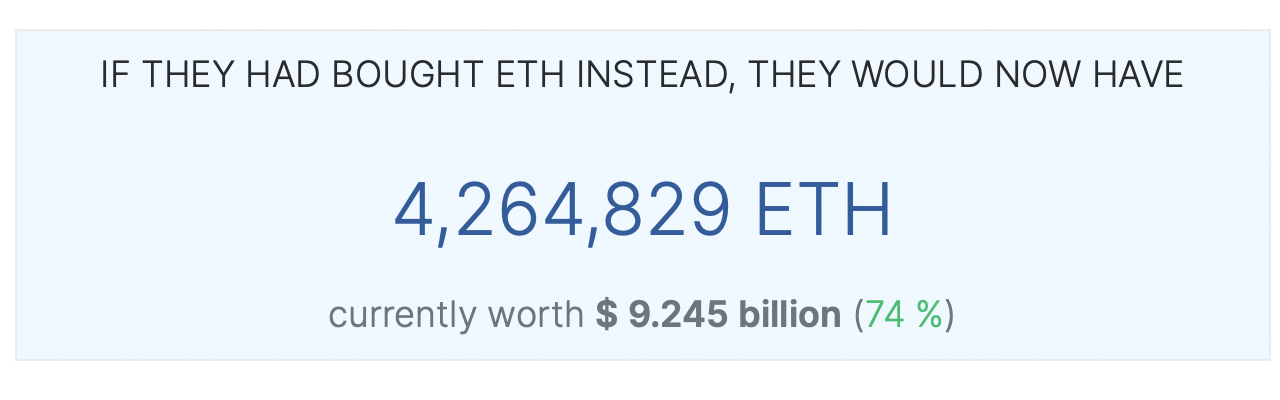

Had the company chosen to invest in ETH, its holdings would amount to 4,264,829 ETH, valued at $9.245 billion. This scenario would have yielded a 74% profit, totaling $3.931 billion, far surpassing the 30% gain from BTC holdings. Moreover, this figure does not account for additional earnings from staking the ETH, which at a 4% annual percentage yield (APY), could have contributed another $869.4 million to Microstrategy’s profits, blockchaincenter.net’s chart shows.

In such a case, Microstrategy’s total valuation with ETH, including USD gains and staking benefits, would stand at an impressive $10.114 billion. However, this remains a hypothetical scenario, as Microstrategy and its CEO Michael Saylor are firm believers in bitcoin, with Saylor famously stating, “There is no second best crypto asset.” When it comes to holding size, Microstrategy’s BTC assets represent 27.92% of Grayscale’s Bitcoin Trust’s holdings, showcasing the substantial amount of bitcoin in their portfolio compared to any private or public business.

Microstrategy’s stock performance has been sizable, with MSTR shares increasing by 167% over the past year. Since the beginning of the year, MSTR has seen a gain of 262%, and in the last month alone, shares have risen by 22%. When examining the top assets by market valuation, which encompasses exchange-traded funds (ETFs), cryptos, and precious metals, Microstrategy’s market capitalization ranks as the 1,768th largest globally. Concurrently, bitcoin boasts the 11th highest market valuation worldwide, positioned just below Warren Buffet’s Berkshire Hathaway.

What do you think about Microstrategy’s bitcoin holdings and the gains recorded so far? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/YxsfHzD