Microstrategy has expanded its bitcoin holdings with the acquisition of 16,130 more bitcoins. With this latest purchase, the Nasdaq-listed software intelligence firm is now hoding 174,530 bitcoins, acquired for around $5.28 billion. Since adopting its bitcoin strategy, Microstrategy’s stock has outperformed major asset classes and indices.

Microstrategy’s Bitcoin Treasury Rises to 174,530 Coins

Microstrategy (Nasdaq: MSTR) has disclosed its most recent acquisition of bitcoin. The firm’s chairman and former CEO, Michael Saylor, shared on social media platform X Thursday:

Microstrategy has acquired an additional 16,130 BTC for ~$593.3 million at an average price of $36,785 per bitcoin. As of 11/29/23, Microstrategy now hodls 174,530 $BTC acquired for ~$5.28 billion at an average price of $30,252 per bitcoin.

According to the company’s filing with the U.S. Securities and Exchange Commission (SEC), the additional coins were acquired in cash during the period between Nov. 1 and Nov. 29.

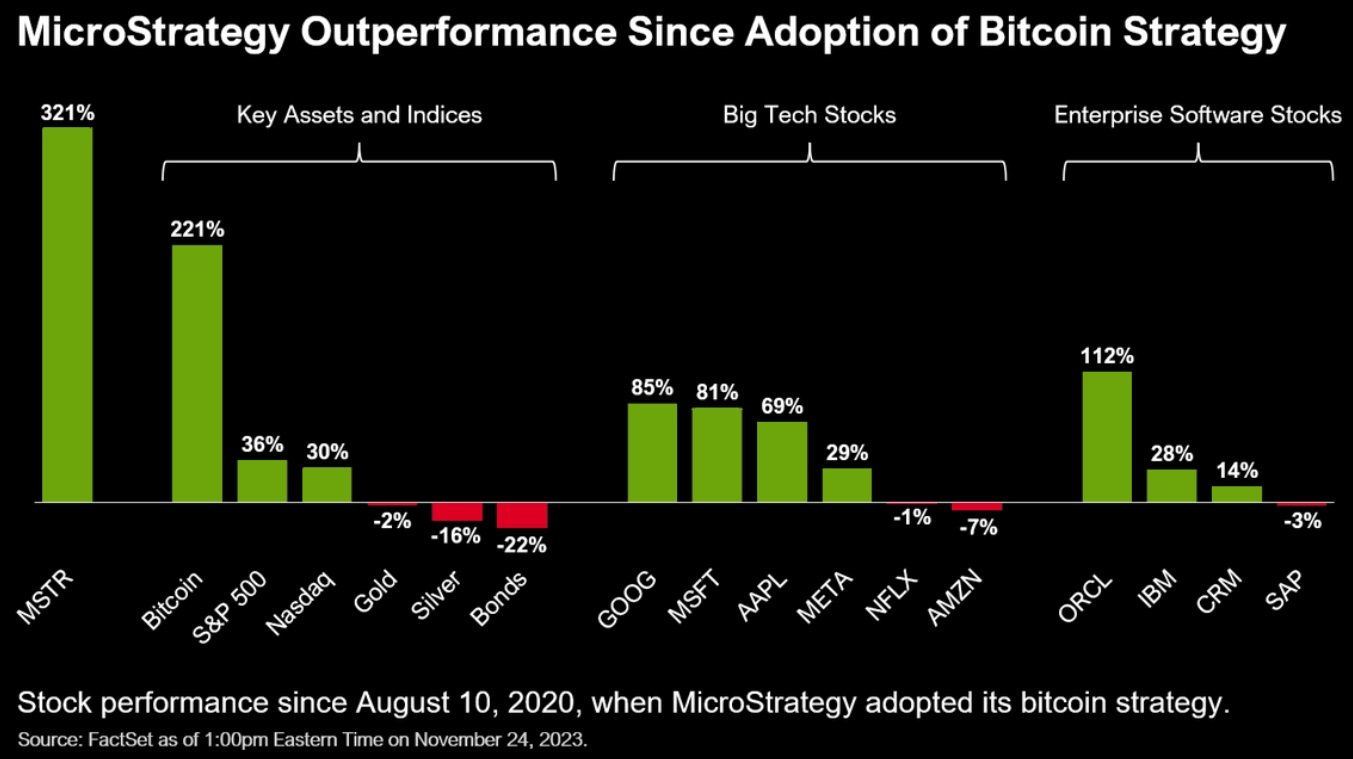

Since Microstrategy adopted its bitcoin strategy on Aug. 10, 2020, its stock has surged by 321%, according to a chart shared by Saylor on X, showing the performances of MSTR, bitcoin, as well as other well-known asset classes, indices, and stocks. In the same period, bitcoin rose by 221%, the S&P 500 experienced a 36% increase, and the Nasdaq Composite index saw a 30% rise. Meanwhile, gold declined by 2%, silver fell by 16%, and bonds dropped by 22%.

The software intelligence firm also reported to the SEC in Thursday’s filing that it entered into a letter agreement on Nov. 29, terminating the sales agreement it had with Cowen, Canaccord, and Berenberg Capital Markets. The sales agreement, established on Aug. 1, allowed Microstrategy to issue and sell shares of its common stock with an aggregate offering price of up to $750 million. Before the termination, Microstrategy issued and sold 1,189,588 shares of its common stock between Nov. 1 and Nov. 28, generating net proceeds of approximately $590.9 million. The company previously stated that these proceeds would be used to acquire bitcoin.

Saylor previously explained that his company’s bitcoin strategy “seeks to maximize long-term value” for shareholders. He described the world’s largest cryptocurrency as “a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash.” The executive added: “Since its inception over a decade ago, bitcoin has emerged as a significant addition to the global financial system, with characteristics that are useful to both individuals and institutions.”

What do you think about Microstrategy holding 174,530 bitcoins? Let us know in the comments section below.

from Bitcoin News https://ift.tt/7CtxuX8