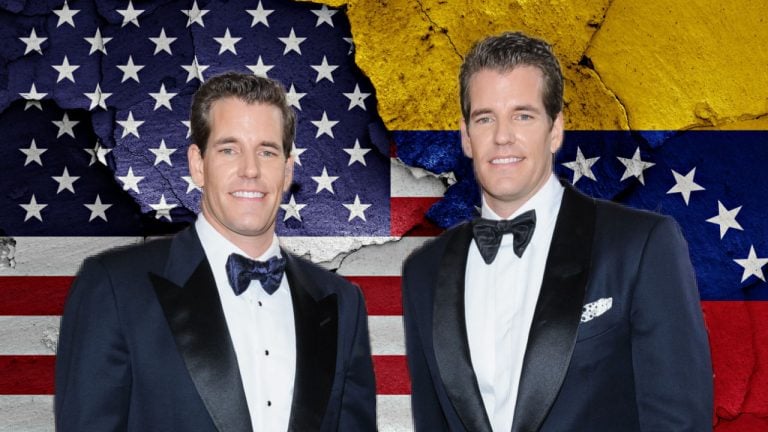

The Winklevoss twins, founders of Gemini, a U.S.-based cryptocurrency exchange, have criticized the U.S. Securities and Exchange Commission (SEC) for its perceived anti-crypto stance and recent enforcement actions. In a recent interview, the Winklevoss twins commented that the regulatory environment in the U.S. felt like “third world, like Venezuela,” for builders in the crypto world.

Winklevoss Twins Against SEC: Building Crypto in the U.S. ‘Feels Like Venezuela’

Tyler and Cameron Winklevoss, founders of Gemini, a U.S.-based cryptocurrency exchange, have criticized the regulatory environment that crypto builders face in the country with the recent enforcement actions of the U.S. Securities and Exchange Commission (SEC).

In a recent interview with Balaji Srinivasan, former CTO of Coinbase, the Winklevoss twins explained the difficulties that existing regulation poses to cryptocurrency investors. They detailed that the launch of a rule-compliant cryptocurrency exchange in the U.S. involved getting a state license for every state served and a money transfer license (MTL), raising the costs to enter the crypto business.

In addition, the Winklevoss twins criticized the “regulation by enforcement” approach of the SEC, stating:

They won’t tell you what you need to do to comply. They won’t tell you these are the roads, they are paved, there’s a speed limit… There isn’t that path for people who want to comply.

Furthermore, they explained that building in crypto in the U.S. “feels like Venezuela,” commenting that common protections do not apply in the crypto world.

Further Criticism

The Winklevoss twins further criticized the lack of clarity of the SEC regarding the classification of certain cryptocurrency assets. In the case of ether, the twins detailed that even though the Ethereum network is ten years old, there is still no clarity about how it will be classified, with SEC Chairman Gary Gensler refusing to answer a direct question on the subject in a congressional hearing in April.

They declared:

The only thing that that U.S. regulators seem to agree on is that bitcoin is a commodity but they won’t agree on any other crypto.

Due to all of these complications, the Winklevoss twins believe that there will be a crypto “flippening” from America to Asia, where regions such as the Asia Pacific (APAC) and the Middle East and North Africa (MENA) will grow to be the largest source of revenue for Gemini. Compared to the U.S., where the twins explained the “environment is hostile and you can’t get anything done,” these jurisdictions offer friendlier crypto regulations.

Others have warned about crypto fleeing to other, less hostile markets, including Coinbase CEO Brian Armstrong and U.S. Senator Cynthia Lummis.

What do you think of the opinions of the Winklevoss twins on the state of crypto regulation in the U.S.? Tell us in the comment section below.

from Bitcoin News https://ift.tt/BZkcQoN