Bitcoin has seen a pullback since peaking around $23,900 yesterday. Here’s what Santiment says is the possible reason behind this decline.

Bitcoin Observes Largest Profit To Loss Transaction Ratio In 2 Years

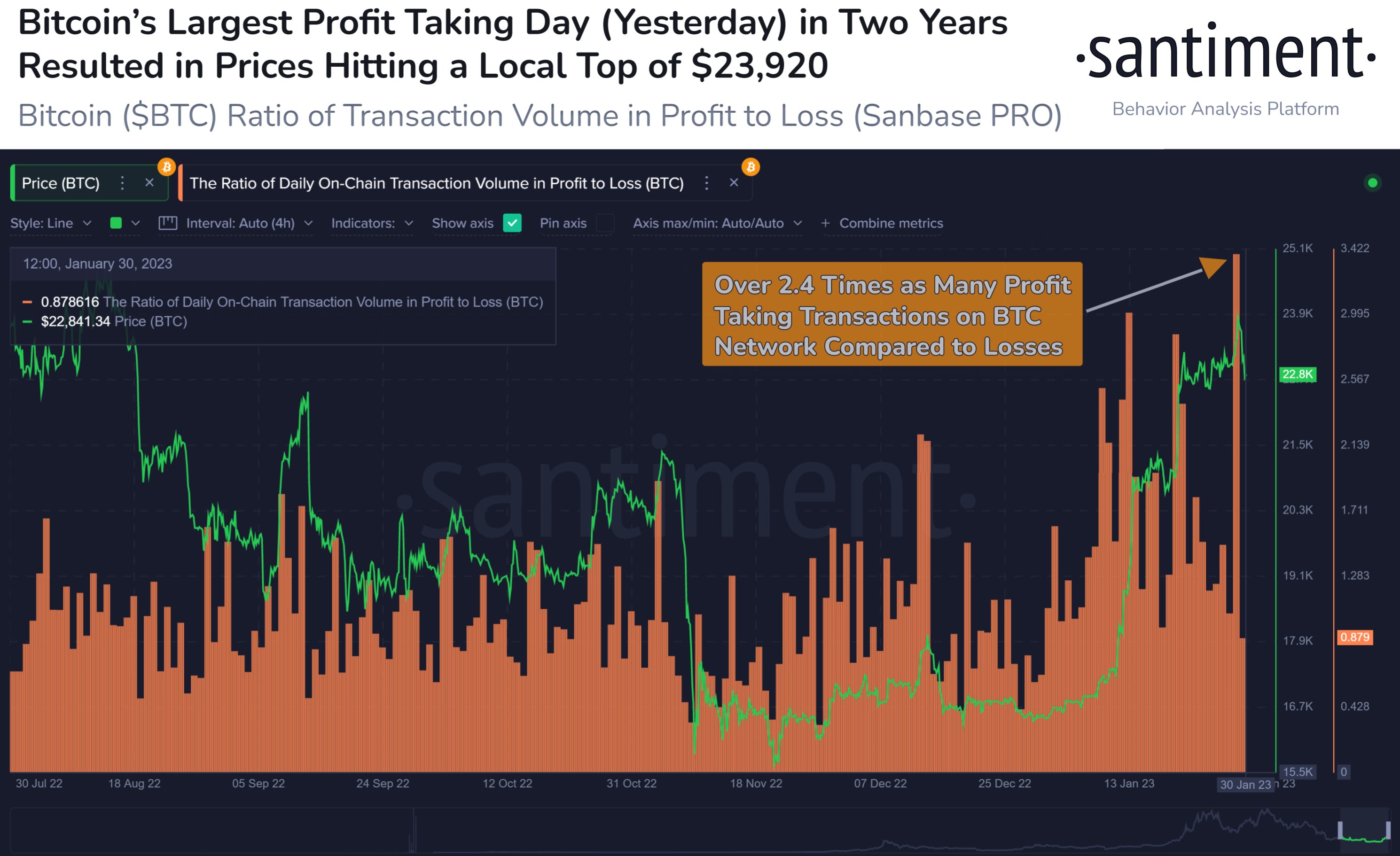

As per data from the on-chain analytics firm Santiment, yesterday was the largest profit-taking day for BTC since February 2021. The relevant indicator here is the “ratio of on-chain transaction volume in profit to loss,” which, as its name already implies, measures the ratio between the daily volume being involved in profit-taking transactions and that involved in loss-taking ones.

The indicator works by looking through the on-chain history of each coin in the circulating supply to see what price it was last moved at. If this previous price for any coin was less than the current value of Bitcoin, then that coin is said to be holding a profit. Now, if the coin is sold while in this state, its sale transaction would contribute towards the profit volume.

On the other hand, the metric would count the volume under the loss-taking type if the coin is sold while the BTC price is less than its last transfer value.

When the ratio between these two volumes is greater than 1, it means there are more profit-taking transactions taking place on the network right now. On the other hand, values lower than the threshold imply that loss-taking is dominant currently.

Now, here is a chart that shows the trend in this Bitcoin ratio over the last few months:

As shown in the above graph, the ratio between profit and loss transactions for Bitcoin was at a very high level during the past day. In this spike, there were more than 2.4 times as many profit-realizing transfers happening on the blockchain as compared to the loss-taking ones. This level of profit-taking is the highest observed since February 2021, around two years ago.

Interestingly, the latest surge in the metric coincided with BTC hitting a high of $23,900 yesterday. Since then, however, BTC has sharply declined and is now below the $23,000 level. This would suggest that it might have been these profit-taking transactions that have led to the latest pullback in the price of the cryptocurrency.

Today, after the BTC value has declined, the indicator’s value has also dropped off and is now below 1, implying that profit-taking has stopped and loss-realizing transfers are taking over now. This could be bullish for the coin, however, as Santiment explains, “If loss transactions pile up now, prices are more likely to bounce right back.”

BTC Price

At the time of writing, Bitcoin is trading around $22,800, down 1% in the last week.

from NewsBTC https://ift.tt/la8cgdk