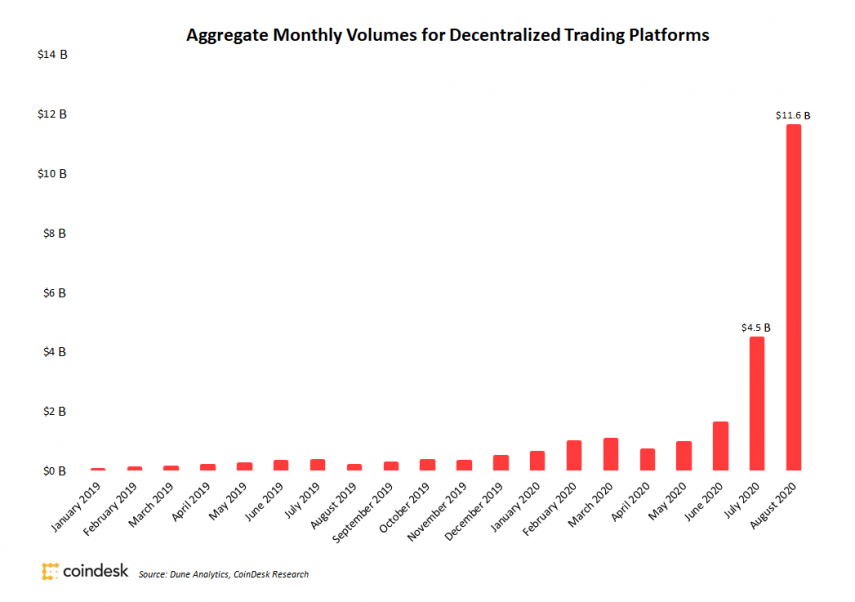

The first quarter of 2020 saw $5.1 billion added in volume to decentralized exchanges, 500% increase from the first 6 months in 2019.

Data obtained from coindex

Data obtained from coindex

This is made possible due to the recent rave that DeFi projects have caught on, the DeFi spark ignited the increased use of DEX platforms and platforms such as Uniswap, Bounce came to life, raking in billions on daily volume. In August 2020 it was reported that the daily volume of trades on Uniswap surpassed that of Coinbase Pro for the first time as Uniswap added $1 billion in 24hrs volume owing to the explosion of the DeFi market.

Already established projects would adopt the DeFi rave to gain incredible value when they list on a DEX platform, new projects quickly adopted the DeFi principle, soon everyone’s vision is changing face and taking on the DeFi mantra. What seems like a huge leap for the market is starting to slow down in momentum for quite a number of obvious reasons.

Transaction costs: The issue of increased gas fee has been a lingering problem for some time. Popular existing DEX aggregators, Uniswap and Bounce are built on the Ethereum network, because of the huge number of participants at a given instant, Ethereum transactions would naturally slow down a lot, increasing the price such that Miners would only take on transactions with high fees. This by itself has slowed down the adoption of the DeFi market. There is a need to look at other effective chains that offer cheaper fees and faster transactions.

Interoperability: Currently there is no DEX protocol that allows for interoperations of various coins from different projects. Only projects under the Ethereum infrastructure can list on Uniswap, same for Bounce and PrimalBlock. It’s quite limiting for the growth and development of the DeFi economy. With this limitation, cross partnership across different chains will not be achieved, we will have competition instead of collaboration.

Cross-chain swap: When interoperability is achieved, a cross-chain swap of a pool of interoperable tokens becomes absolutely needed. Giving users the freedom to make the swap from one blockchain to another without incurring extra charges in a quick and efficient manner solves the current problem in already existing solutions, which have begun to see a drop in activities in recent times.

Polkastarter protocol will be the first DEX aggregator to initiate the cross-chain swaps for interoperable tokens. The project is set to solve the existing problems associated with DeFi Dex protocol in areas of fundraising, Auctions, and OTC trades. Polkastarter stands out when placed side by side with existing solutions.

As mentioned, no existing solution has gotten the cross-chain pools integrated on their protocol save for Polkastarter network, we can’t emphasize enough the ease of doing business this will create. Only 1 of the existing solutions supports any kind of asset types in the DeFi market and even that is restricted to Ethereum assets.

The permissionless nature of Polkastarter DEX gives the public the right to audit or read/write the transaction in the network without permission. This way, projects are constantly verified by both the team and members of the public through smart contract auditing. By making the aggregator public for verification purposes Polkastarter has scored an incredible goal in the net of transparency typical of a truly decentralized blockchain network.

Governance

Polkastarter brings a missing ingredient in existing protocols with the integration of the governance feature on its network, holders of the $POL token, the official token for the network will have the exclusive right to vote on product features, token utility, type of auctions, and even decides which projects get to be listed, all of these will be fueled by $POL token.

Community involvement in the activities done within the protocol is crucial for development, increased faith in the protocol, and long term existence of the platform. Some known DeFi protocols e.g. YearnFinance have adopted this approach which has increased the growth of the token value to an unimaginable height surpassing the price of Bitcoin.

By enabling all of these attributes plus cross-chain swaps, Polkastarter is already set up to become the standard for DEX protocols, by being built on the Polkadot network, it suggests that the network can handle the large audience of the DeFi market without encountering a major setback. The network is tested and already shows strength. And unlike other existing protocols, Polkastarter will ensure simplicity of its UI/UX at best for everyday users who aren’t entirely familiar with how a typical Dex protocol works.

from NewsBTC https://ift.tt/2S4gcBE