Bitcoin is ripping higher once again. In the past few hours, the leading cryptocurrency has begun to test the year-to-date highs at $11,500. And just minutes ago, BTC reached a local high of $11,700 after an influx of buying pressure.

It is unclear if this rally is sustainable yet: Bitcoin has yet to close above $11,500 on any longer-term time frames like the 4-hour, 12-hour, or one-day charts.

Chart of BTC's price action over the past 10 days from TradingView.com

Analysts say that Bitcoin breaking past $11,500 increases the potential for the asset to surge even higher in the weeks ahead. This is largely due to the fact that $11,500 was a pivotal macro level during early 2018 — after the $20,000 peak in December 2017.

Related Reading: Crypto Tidbits: Ethereum Surges 20%, US Banks Can Hold Bitcoin, DeFi Still in Vogue

Bitcoin Breaking Past $11,500 Is Pivotal

Bitcoin decisively surging above $11,500 is setting the stage for an even greater move to the upside, say analysts.

A cryptocurrency trader shared the chart below on July 31st. It indicates that BTC retaking $11,500 — or $11,463 to be more specific — on a weekly and monthly time frame will send leave Bitcoin with little resistance until the $20,000 all-time high.

“Few hours to go before a massive monthly close. Few days to go to close the weekly above 11.5k.I personally wouldn’t have any problems with the Ear of maize hovering between 10k and 11.5k if that’s what needed for sustainable growth to ATH.”

Chart of BTC's macro price action from trader Pierre (@Pierre_crypt0 on Twitter). Chart from Tradingview.com

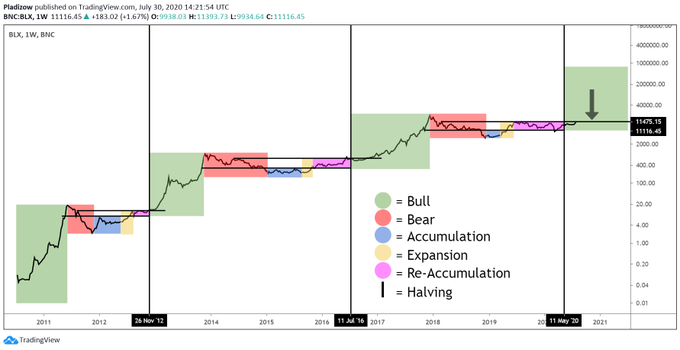

The importance of $11,500 to the long-term Bitcoin bull case has been echoed by a ryptocurrency chartist. The chartist indicated that per a “structural fractal” that takes inputs from all of BTC’s previous bull cycles, Bitcoin breaking past $11,500 will lead to a full-blown bull market: c

“This structural fractal and its current level seem to align well at around $11.5K with the 50% fib fractal I posted yesterday. Different charting techniques that converge on similar price levels lend them credence. What do you think?”

Chart of BTC's macro price action from trader/chartist "Nunya Bizniz" (@pladizow on Twitter). Chart from Tradingview.com

A Sustainable Rally?

Derivatives data suggests that Bitcoin’s ongoing move higher is likely sustainable — or at least more so than the surge past $10,000, then $10,500, then $11,000 on Monday.

Table of BTC's funding rates across top perpetual swap futures markets. Data shared by Byzantine General (@Byzgeneral on Twitter).

The above table is Bitcoin’s funding rates across leading margin exchanges. Funding rates are currently moving towards 0%, indicating that buyers are not overextended and have room to push BTC higher.

Related Reading: On-Chain Metric Signals the BTC Market Isn’t Overheated: Why This Is Bullish

Featured Image from Shutterstock Price tags: Charts from TradingVIew.com BTCJust Broke Past $11,500—and That's Huge For Bulls

from NewsBTC https://ift.tt/3hUasp8